description

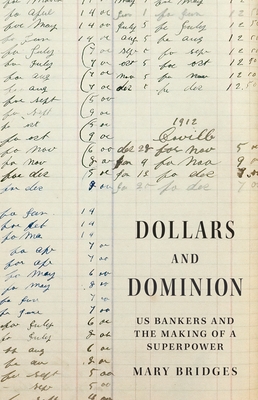

ing infrastructure in the early twentieth century established the United States as a global financial power The dominance of US multinational businesses today can seem at first like an inevitable byproduct of the nation's superpower status. In Dollars and Dominion, Mary Bridges tells a different origin story. She explores the ramshackle beginnings of US financial power overseas, showing that US bankers in the early twentieth century depended on the US government, European know-how, and last-minute improvisation to sustain their work abroad. Bridges focuses on an underappreciated piece of the nation's financial infrastructure--the overseas branch bank--as a brick-and-mortar foundation for expanding US commercial influence. Bridges explores how bankers sorted their new communities into "us"--potential clients--and "them"--local populations, who often existed on the periphery of the banking world. She argues that US bankers mapped their new communities by creating foreign credit information--and by using a financial asset newly enabled by the Federal Reserve System, the bankers' acceptance, in the process. In doing so, they constructed a new architecture of US trade finance that relied on long-standing inequalities and hierarchies of privilege. Thus, racialized, class-based, and gendered ideas became baked into the financial infrastructure. Contrary to conventional wisdom, there was nothing inevitable or natural about the rise of US finance capitalism. Bridges shows that US foreign banking was a bootstrapped project that began as a side hustle of Gilded Age tycoons and sustained itself by relying on the power of the US state, copying the example of British foreign bankers, and building alliances with local elites. In this way, US bankers constructed a flexible and durable new infrastructure to support the nation's growing global power.

member goods

No member items were found under this heading.

Return Policy

All sales are final

Shipping

No special shipping considerations available.

Shipping fees determined at checkout.