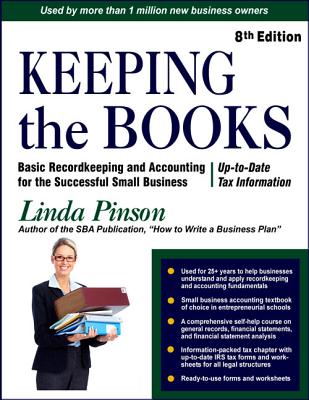

Pinson, Linda

product information

description

4Now in its 27th year, this is one of the most successful and effective guides to preparing and analyzing financial statements, setting up bookkeeping systems, and planning for taxes. Featuring chapters on income and expenses, cash accounting vs. accrual accounting, numerous small business resources, and a rundown of facts about independent contracting, it has been updated to reflect the latest forms and worksheets. A favorite in classrooms and libraries and widely used in colleges, universities, small business development centers, and vocational training courses, the guide has helped hundreds of thousands of new entrepreneurs to understand and apply small business recordkeeping practices that have contributed significantly to increased profits.

member goods

No member items were found under this heading.

Return Policy

All sales are final

Shipping

No special shipping considerations available.

Shipping fees determined at checkout.