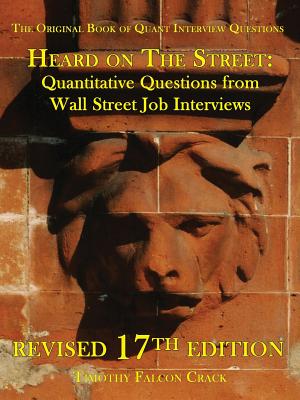

Crack, Timothy Falcon

Note: eBook version of latest edition now available; see Amazon author page for details.] THIS IS A MUST READ It is the first and the original book of quantitative questions from finance job interviews. Painstakingly revised over 21 years and 17 editions, Heard on The Street has been shaped by feedback from many hundreds of readers. With over 50,000 copies in print, its readership is unmatched by any competing book. The revised 17th edition contains 190 quantitative questions collected from actual job interviews in investment banking, investment management, and options trading. The interviewers use the same questions year-after-year, and here they are with detailed solutions This edition also includes over 145 non-quantitative actual interview questions, giving a total of more than 335 actual finance job interview questions. There is also a revised section on interview technique based on Dr. Crack's experiences interviewing candidates and also based on feedback from interviewers worldwide. The quant questions cover pure quant/logic, financial economics, derivatives, and statistics. They come from all types of interviews (corporate finance, sales and trading, quant research, etc.), and from all levels of interviews (undergraduate, MS, MBA, PhD). The first seven editions of Heard on the Street contained an appendix on option pricing. That appendix was carved out as a standalone book many years ago and it is now available in its revised fourth edition: "Basic Black-Scholes" ISBN=978-0994138682. Dr. Crack has a PhD from MIT. He has won many teaching awards, and has publications in the top academic, practitioner, and teaching journals in finance. He has degrees/diplomas in Mathematics/Statistics, Finance, Financial Economics and Accounting/Finance. Dr. Crack taught at the university level for over 20 years including four years as a front line teaching assistant for MBA students at MIT. He has worked as an independent consultant to the New York Stock Exchange, and his most recent practitioner job was as the head of a quantitative active equity research team at what was the world's largest institutional money manager.