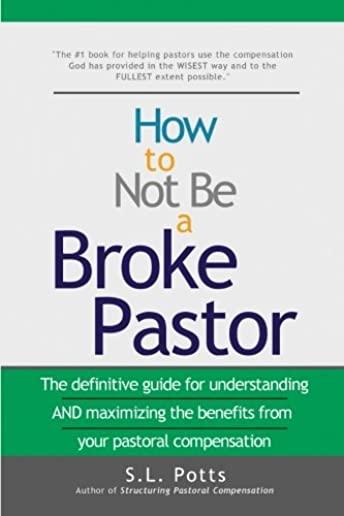

Potts, S. L.

Most pastors "don't know what they don't know" about the unique and confusing world of pastoral compensation.

What do you know?

As a pastor, I get it. Not only can our compensation be confusing, but there are also so many different components that need to be balanced . . . it can be hard to put all the pieces together.

How to Not Be a Broke Pastor is written for pastors/ministers and is designed to make the complexities of clergy pay simple and easy to understand, AND ALSO to give you ideas as to how you can use your income to the greatest extent possible.

We may not have entered the ministry to get rich, but that doesn't mean we should be broke. Let me help you understand and maximize the benefits of your compensation today.

member goods

listens & views

SKETCHES OF SPAIN LIVE

by LIEBMAN,DAVE / MANHATTAN SCHOOL OF MUSIC JAZZ ORCH

COMPACT DISCout of stock

$14.75