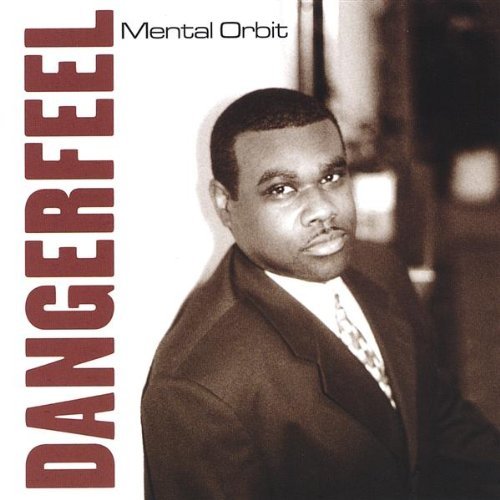

Armer, Chase

product information

description

8Have you ever dealt with an important but complicated financial decision? Have you ever received financial advice that conflicted with advice from another source? Have you ever wondered if the conventional wisdom that many financial gurus share fits your financial situation? The truth is there is no one right way to do financial planning. Everyone's situation, goals, and feelings about money are unique. Financial professionals also have their own perspectives, experiences, and biases that influence their advice. Therefore, it is important to explore and understand the rationale behind the financial advice that you receive so that you can weigh the pros and cons to decide the best path for you. This starts with learning the basics. Next you need to understand how to apply important financial concepts. Finally, you need the financial insights that the pros have developed over years of real-world experience. Author, Dr. Chase W. Armer, has gained a number of financial planning insights from two decades working as a financial planner. Chase holds several degrees and professional designations that give him the background required to address a variety of financial topics. These including a doctorate in business administration, a master's degree in taxation, and a bachelor's degree in economics as well as the Certified Financial Planner (CFP(R)) and Chartered Financial Analyst (CFA) designations. More importantly, during this career Chase has helped countless people address real-life financial challenges. Through this experience he as developed unique views on many common financial topics ranging from cash flow management to investing to risk management and more. Many of these insights will not be found in financial textbooks, self-help books, or the financial press. In fact, many of them are counter to the conventional wisdom that some financial commentators use. Yet these insights should at least be considered before making any financial decisions that could be difficult to reverse or may result in a costly error.Financial Planning Insights contains a series of short chapters each examining an important aspect of personal financial planning. The topics include many of the common financial questions and dilemmas that individuals must confront when planning their financial futures. The objective is to bring a unique perspective on each issue in order to educate readers about the topic, help them evaluate their financial situation, give them the background needed to explore their options, and enable them to execute their strategy with confidence.The topics addressed include: Ways to think about building wealth and creating a financial plan, Different approaches to budgeting and cash management, How to manage financial market and economic cycles, Different ways to think about investing and investment risk, Financial risk minimization and management strategies, How real estate may fit into a financial plan, Income tax planning strategies, Retirement savings challenges and opportunities, End of life wealth planning, and Ways to work more effectively with financial professi

member goods

No member items were found under this heading.

Return Policy

All sales are final

Shipping

No special shipping considerations available.

Shipping fees determined at checkout.