Slesnick, Twila

product information

description

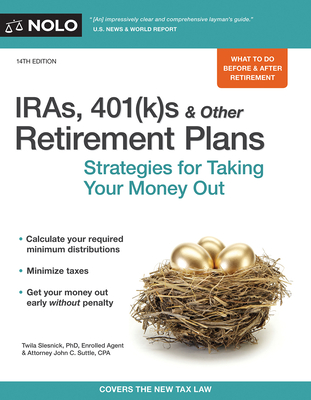

0Save your nest egg from the IRS

About to retire? Over 70 and facing mandatory withdrawal rules? Just inherited money from a retirement plan?

Whether you have an IRA, Roth IRA, 401(k), Keogh or other retirement plan, this book will help you make sense of the rules for taking your money out. Even more important, it will show you how to avoid the stiff taxes and penalties that lurk in the fine print. It covers:

- tax strategies before and after retirement

- required distributions and how much you need to take

- penalties for taking money out early and how to avoid them

- how to divide a plan at divorce

- what happens to your retirement plan after your death, and

- different rules for taking money out of an inherited plan

The 14th edition is completely updated with the latest tables and methods for calculating required minimum distributions. It also covers the special tax benefits for conversions to Roth IRAs and explains how to recharacterize IRA or Roth contributions.

member goods

No member items were found under this heading.

Return Policy

All sales are final

Shipping

No special shipping considerations available.

Shipping fees determined at checkout.