description

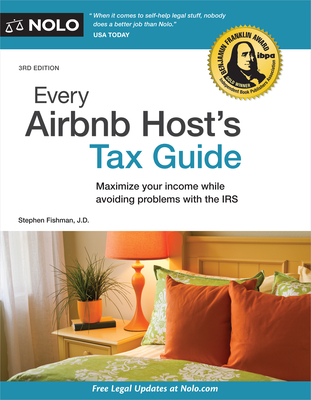

0The complete tax guide for Airbnb and other short-term rental hosts

As a short-term rental host, you're entitled to many valuable deductions and other tax benefits. This book--the first of its kind--shows you how to make the most out of your hosting business without risking problems with the IRS.

Learn everything you need to know about taxes, including:

- deductions you should be taking

- how to report your short-term rental income

- how to deduct losses and

- vacation home and tax-free rental rules.

Whether you rent your property through Airbnb, FlipKey, HomeAway, TripAdvisor, Craigslist, or VRBO, you want to make sure you understand these tax rules, including the new 20% pass-through deduction.

This edition covers the Tax Cuts and Jobs Act.

member goods

No member items were found under this heading.

listens & views

TOSCANINI CONDUCTS

by BEETHOVEN / MOZART / SERKIN / TOSCANINI / NYP

COMPACT DISCout of stock

$13.49

Return Policy

All sales are final

Shipping

No special shipping considerations available.

Shipping fees determined at checkout.