description

8

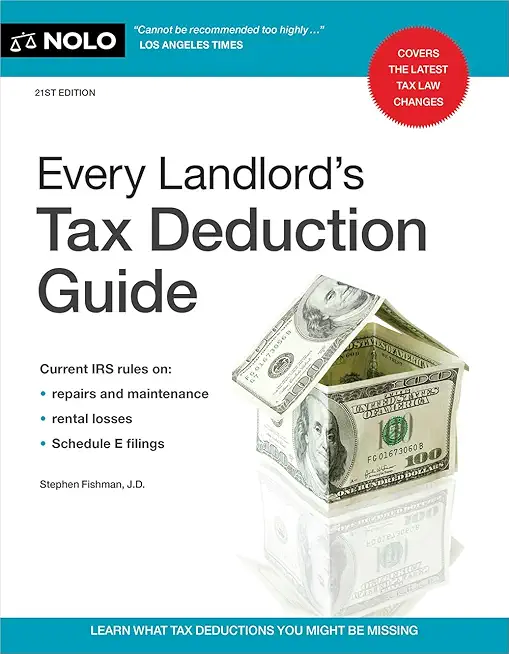

Maximize your tax deductions

Rental real estate provides more tax benefits than almost any other investment. If you own residential rental property, Every Landlord's Tax Deduction Guide is an indispensable resource, focusing exclusively on IRS rules and deductions for landlords.

This book covers the latest tax laws, including the rules for deducting a net operating loss (NOL) and claiming an NOL refund. Learn about landlord tax classifications, reporting rental income, hiring workers, and depreciation.

Find out how to:

- handle casualty and theft losses

- distinguish between repairs and improvements

- deduct home office, car, travel, and meals

- keep proper tax records--and much more.

Filled with practical advice and real-world examples, Every Landlord's Tax Deduction Guide will save you money by helping you owe less to the IRS at tax time.

member goods

No member items were found under this heading.

Return Policy

All sales are final

Shipping

No special shipping considerations available.

Shipping fees determined at checkout.