description

by historians, is precisely the key to unlocking many historical puzzles, the compass to discern the maze of today's reality, and the telescope to discover the road to the future. In the course of studying the financial history of Europe, America, China and Japan, I have a growing feeling that finance is the "fourth dimensional frontier" that a sovereign country must defend. The concept of the frontiers of sovereign states does not only include the three-dimensional physical space constituted by the land, sea and air frontiers (including space), but in the future it needs to include a new dimension: finance. The importance of the financial high frontier will become increasingly important in the coming era of cloudy international currency wars.

From the path of financial evolution in Europe and the United States, it can be clearly found that the currency standard, central banks, financial networks, trading markets, financial institutions and clearing centers together constitute the system architecture of financial high frontier. The main purpose of this system is to ensure efficient and secure resource mobilization for currency pairs. From the source of the central bank to create money, to the customer terminal that eventually accepts money; from the dense network of money flow, to the clearing center of funds remittance; from the trading market of financial instruments, to the rating system of credit assessment; from the soft regulation of the financial legal system, to the construction of rigid financial infrastructure; from the huge financial institutions, to efficient industry associations; from complex financial products, to simple investment instruments, the financial high frontier protects the monetary blood from the heart of the central bank, to the financial capillaries and even the whole body economic cells, and eventually back to the central bank's circulation system.

From the path of financial evolution in Europe and the United States, it can be clearly found that the currency standard, central banks, financial networks, trading markets, financial institutions and clearing centers together constitute the system architecture of financial high frontier. The main purpose of this system is to ensure efficient and secure resource mobilization for currency pairs. From the source of the central bank to create money, to the customer terminal that eventually accepts money; from the dense network of money flow, to the clearing center of funds remittance; from the trading market of financial instruments, to the rating system of credit assessment; from the soft regulation of the financial legal system, to the construction of rigid financial infrastructure; from the huge financial institutions, to efficient industry associations; from complex financial products, to simple investment instruments, the financial high frontier protects the monetary blood from the heart of the central bank, to the financial capillaries and even the whole body economic cells, and eventually back to the central bank's circulation system.

member goods

No member items were found under this heading.

listens & views

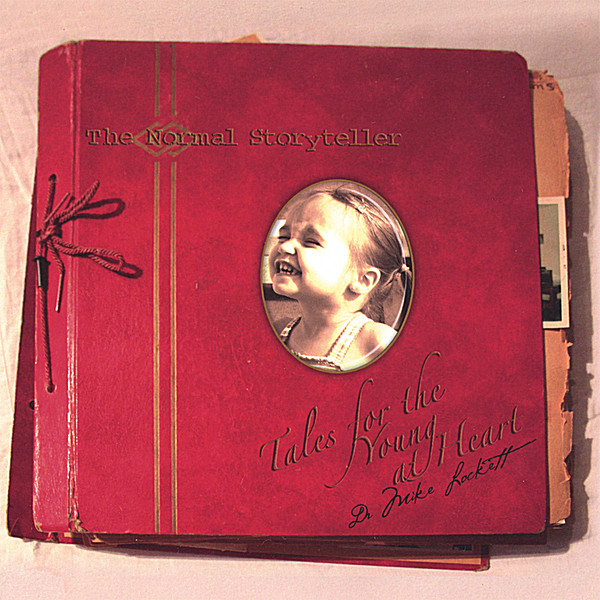

TALES FOR THE YOUNG AT ...

by LOCKETT,MIKE. DR. THE NORMAL STORYTELLER

COMPACT DISCout of stock

$15.75

Return Policy

All sales are final

Shipping

No special shipping considerations available.

Shipping fees determined at checkout.