description

Book Excellence Awards

Nonfiction Book Awards Silver Medal Recipient 2024

Winner of Best Business Book at the Los Angeles Book Festival 2023

Winner of Best Business Book at the New England Book Festival 2023

Winner of Best Business/Technology Book at the Southern California Book Festival 2023

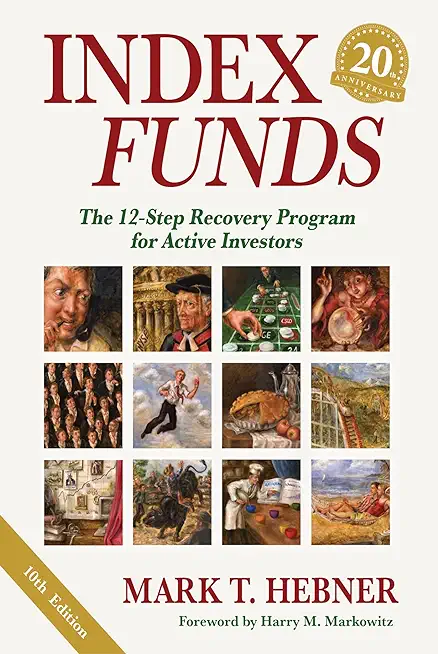

This secret quietly drains the investment portfolios and retirement accounts of almost every investor. In 1900, French mathematician Louis Bachelier unwittingly revealed this disturbing fact to the world. Since then, hundreds of academic studies have supported Bachelier's findings. Unfortunately, investors pay little attention to academics and Nobel laureates.

What is the dark secret? It's that managers don't beat markets. In fact, markets outperform managers by a substantial margin over long periods of time. Index Funds: The 12-Step Recovery Program for Active Investors offers overwhelming proof of this and shows investors how to obtain optimal rates of return by matching their risk capacity to an appropriate risk exposure. A globally diversified portfolio of index funds is the optimal way to accomplish this.

Most investors continue to embrace an active investing strategy despite the extensive academic research demonstrating its futility. Market timing or speculating on the next winning stock, fund manager, or investment style are all akin to gambling. Below-market returns in investment portfolios and pension accounts are the result of investors gambling with their hard-earned money. This twelve-step program will put active investors on the road to recovery. Each step is designed to bring investors closer to embracing a prudent and sound strategy of buying, holding, and rebalancing an index portfolio.

Index Funds: The 12-Step Recovery Program for Active Investors is the treatment of choice for wayward investors. It has been praised by Jack Bogle, Harry Markowitz, Burton Malkiel, David Booth, Paul Samuelson, and Theodore Aronson, among others. Investment advisor Anders Oldenburg of Seligson & Company nominated the previous version as one of the three "All-Time Greatest Investment Books," along with the writings of John Bogle and Warren Buffett.

This one-of-a-kind little jewel is an eye-pleasing manifestation of hundreds of studies and decades of research, and it clearly represents Hebner's ongoing commitment to educate investors throughout the world. It is destined to emerge as the go-to handbook for intelligent, evidence-based investing.

Nonfiction Book Awards Silver Medal Recipient 2024

Winner of Best Business Book at the Los Angeles Book Festival 2023

Winner of Best Business Book at the New England Book Festival 2023

Winner of Best Business/Technology Book at the Southern California Book Festival 2023

"A no-nonsense guide to disciplined investing, full of deep insights framed in compelling ways."

--Kirkus Reviews

This secret quietly drains the investment portfolios and retirement accounts of almost every investor. In 1900, French mathematician Louis Bachelier unwittingly revealed this disturbing fact to the world. Since then, hundreds of academic studies have supported Bachelier's findings. Unfortunately, investors pay little attention to academics and Nobel laureates.

What is the dark secret? It's that managers don't beat markets. In fact, markets outperform managers by a substantial margin over long periods of time. Index Funds: The 12-Step Recovery Program for Active Investors offers overwhelming proof of this and shows investors how to obtain optimal rates of return by matching their risk capacity to an appropriate risk exposure. A globally diversified portfolio of index funds is the optimal way to accomplish this.

Most investors continue to embrace an active investing strategy despite the extensive academic research demonstrating its futility. Market timing or speculating on the next winning stock, fund manager, or investment style are all akin to gambling. Below-market returns in investment portfolios and pension accounts are the result of investors gambling with their hard-earned money. This twelve-step program will put active investors on the road to recovery. Each step is designed to bring investors closer to embracing a prudent and sound strategy of buying, holding, and rebalancing an index portfolio.

Index Funds: The 12-Step Recovery Program for Active Investors is the treatment of choice for wayward investors. It has been praised by Jack Bogle, Harry Markowitz, Burton Malkiel, David Booth, Paul Samuelson, and Theodore Aronson, among others. Investment advisor Anders Oldenburg of Seligson & Company nominated the previous version as one of the three "All-Time Greatest Investment Books," along with the writings of John Bogle and Warren Buffett.

This one-of-a-kind little jewel is an eye-pleasing manifestation of hundreds of studies and decades of research, and it clearly represents Hebner's ongoing commitment to educate investors throughout the world. It is destined to emerge as the go-to handbook for intelligent, evidence-based investing.

member goods

No member items were found under this heading.

listens & views

MASTERS OF OLD TIME COUNTRY ...

by MASTERS OF OLD TIME COUNTRY AUTOHARP / VARIOUS

COMPACT DISC$15.75

Return Policy

All sales are final

Shipping

No special shipping considerations available.

Shipping fees determined at checkout.