description

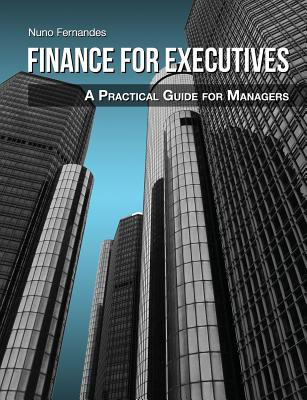

7The book Finance for Executives: A Practical Guide for Managers meets the needs of global executives, both finance as well as non-financial managers. It is a practical and fundamental finance reference book for any manager, as it makes a perfect balance of financial management theory and practice. It focuses on corporate finance concepts from value creation to derivatives, including cost of capital (and WACC), valuation, financing policies, project evaluation, and many other essential finance definitions.

Finance for Executives makes finance simple and intuitive, through the use of real world data (brief company case studies and empirical examples of concepts), Excel financial modelling tools, and practical short chapters.

Target Audience

This finance book is appropriate for business executives, from all backgrounds, seeking to

What Is This Book About?

Finance should be fun, and practical as well. With this book at hand, you will have access to a set of tools that will help you develop your intuition for solving key financial problems, improve your business decisions, and formulate strategies.

This finance for managers' reference book is based on

An Excel spreadsheet containing all the financial models used in the different chapters is available for download from the book's website. Practitioners will find the file easy to customize to their own requirements. It is useful in a variety of situations: value creation and its decomposition into managerial drivers or key performance indicators (KPIs), cost of capital (WACC) estimation, project evaluation, mergers and acquisitions, company valuation, derivatives valuation, etc.

Finance for Executives makes finance simple and intuitive, through the use of real world data (brief company case studies and empirical examples of concepts), Excel financial modelling tools, and practical short chapters.

Target Audience

This finance book is appropriate for business executives, from all backgrounds, seeking to

- Focus on the links between financial management and the strategy of their company, be it a private or publicly traded company

- Discover how to create value for their company and boost its financial performance

- Understand the key topics of corporate finance for non-financial managers

- Create a cost of capital culture within a company

- Refresh and broaden their understanding of the latest financial concepts and tools

- Learn about financial management for decision makers - including financing and dividend policies, company valuation, mergers and acquisitions (M&As), project evaluation, cost of capital (WACC) estimation, or risk management and derivatives

What Is This Book About?

Finance should be fun, and practical as well. With this book at hand, you will have access to a set of tools that will help you develop your intuition for solving key financial problems, improve your business decisions, and formulate strategies.

This finance for managers' reference book is based on

- Simplicity - The core concepts in corporate finance are simple, and will become intuitively clear after using this book

- Conciseness - The chapters are short and self-contained to appeal to busy executives who are keen on value-added activities

- Practical focus - The key concepts of financial management are explained (and linked to Excel modelling tools), while you learn to identify the problems and pitfalls of different managerial choices

- Application of theory to practice - It highlights key academic research results that are relevant for practitioners

- Real-world focus - The book includes empirical data on several companies and industries around the world. Working with real-world problems and real-world data is more fruitful than theoretical discussions on formulas

An Excel spreadsheet containing all the financial models used in the different chapters is available for download from the book's website. Practitioners will find the file easy to customize to their own requirements. It is useful in a variety of situations: value creation and its decomposition into managerial drivers or key performance indicators (KPIs), cost of capital (WACC) estimation, project evaluation, mergers and acquisitions, company valuation, derivatives valuation, etc.

member goods

No member items were found under this heading.

Return Policy

All sales are final

Shipping

No special shipping considerations available.

Shipping fees determined at checkout.