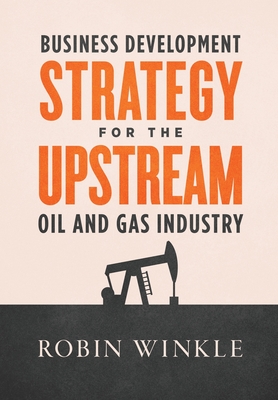

Winkle, Robin

Upstream oil and gas is a commodity industry, which robs the producer of pricing power. It is a cyclical industry, but investment decisions must be made on assumptions of profitability over decades. It is an extractive industry, so continuous investment is required just to maintain output. It is a capital-intensive industry, so mistakes are expensive and joint ventures are the norm. It is a carbon-intensive industry, in a world that is transitioning to renewables. These characteristics differentiate the industry, which is why the industry requires a distinct approach to business-development strategy.

Business Development Strategy for the Upstream Oil and Gas Industry provides a framework for developing that strategy. The book takes the reader through an assessment of portfolio health, organizational capability, and asset mix to understand their competitive advantage and how to convert this into a business development strategy. Featuring industry case studies and including extensive reference material, this book is essential reading for oil and gas executives, financiers, attorneys, and anyone interested in business development in the industry.

Drawing on the author's extensive industry experience, Business Development Strategy for the Upstream Oil and Gas Industry delves into these issues. Employing industry examples and Indie Oil, an illustrative red thread, this book will benefit anyone who works in or around business development in upstream oil and gas, or those interested in learning more about the subject.