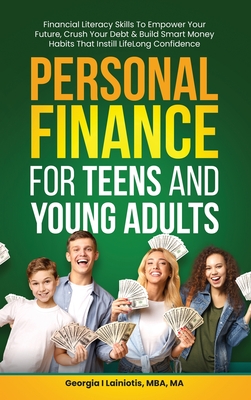

Lainiotis, Georgia I.

Starting with the basics, the book introduces fundamental money management concepts, including budgeting, saving, and responsible spending. It emphasizes the importance of financial literacy from a young age, demonstrating how early habits can shape one's financial future. The guide also explores more advanced topics like investing, insurance, banking, taxes, college loans, credit scores, and the wise use of credit cards, making it a valuable resource for those beginning their financial journey. It also comprehensively reviews job, internship, and entrepreneurial endeavors for teens and young adults.

One of the critical features of this book is its focus on debt management, particularly addressing common concerns faced by young adults, such as student loans and credit card debt. It offers practical debt reduction and avoidance strategies, empowering readers with cutting-edge knowledge to make informed financial decisions.

Beyond just technical financial advice, the book delves into the psychological aspects of money, teaching young adults how to develop a healthy relationship with their finances. It includes real-world scenarios and examples, making the content relatable and easily understood.

Overall, this book is an invaluable tool for any young person looking to take charge of their financial well-being. It's a guide to managing money and an educational resource that builds the confidence and skills necessary for financial independence and success.